When you need money, loans can be a valuable resource, whether for buying a home, paying for education, or covering unexpected expenses. However, understanding where loan money comes from and the types of loans available is essential for making an informed decision. In this comprehensive guide, we will explore the sources of loan money, the different types of loans, their advantages, and comparisons to help you navigate the loan landscape with confidence.

Where Does Loan Money Come From?

Loan money is provided by a variety of financial institutions, each offering different types of loans with varying terms, interest rates, and conditions. The money comes from multiple sources, including banks, credit unions, online lenders, peer-to-peer (P2P) lending platforms, and even government programs.

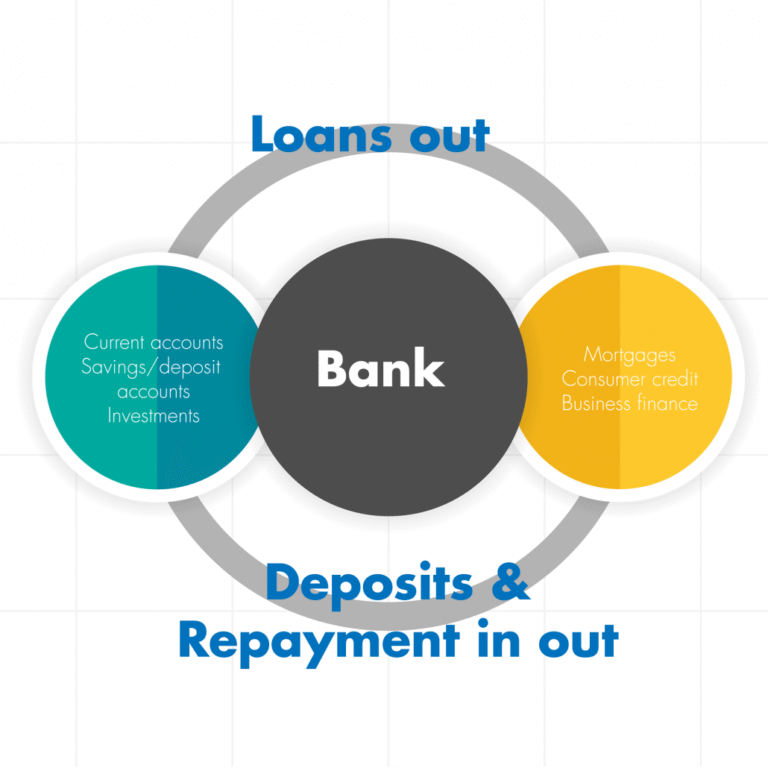

1. Traditional Banks

Banks are one of the most common sources of loan money. They provide personal loans, mortgages, auto loans, and business loans. Banks have the financial resources to lend large sums of money because they hold large deposits from their customers.

- Advantages: Banks often offer competitive interest rates and long repayment terms.

- Disadvantages: Loan approval processes can be strict, requiring a strong credit score and solid financial history.

2. Credit Unions

Credit unions are nonprofit financial institutions that offer similar loan products to banks but typically have more favorable terms, such as lower interest rates. They are member-owned and tend to offer more personalized customer service.

- Advantages: Lower interest rates and fewer fees compared to banks.

- Disadvantages: Limited accessibility since credit unions require membership, which can be based on location, occupation, or other criteria.

3. Online Lenders

Online lenders have become increasingly popular due to their convenience and faster approval processes. They provide various loans, such as personal loans, debt consolidation loans, and sometimes small business loans. Online lenders typically offer flexible application processes with fewer requirements.

- Advantages: Fast approval, minimal paperwork, and ease of access from anywhere.

- Disadvantages: Higher interest rates than traditional lenders due to increased risk and less regulation.

4. Peer-to-Peer (P2P) Lending

P2P lending platforms, like LendingClub or Prosper, connect borrowers directly with individual investors. These platforms allow borrowers to obtain loans at competitive interest rates by bypassing traditional financial institutions.

- Advantages: Competitive interest rates and less stringent approval criteria.

- Disadvantages: Loans are typically smaller, and the platform may charge fees for loan servicing.

5. Government and Federal Loans

Governments, especially the U.S. federal government, offer loans for specific purposes, such as education, home purchases, and small business support. These loans are typically more affordable and come with benefits like low interest rates and long repayment periods.

- Advantages: Low interest rates, government-backed, and flexible repayment options.

- Disadvantages: May require specific qualifications or conditions, and the application process can be bureaucratic.

6. Private Lenders and Investors

Private lenders, such as family members, friends, or private companies, can provide loans outside the traditional banking system. These loans are typically informal, without the stringent criteria of banks or credit unions.

- Advantages: Flexible terms and often more personal.

- Disadvantages: The risk of straining personal relationships and the lack of formal contract enforcement.

Types of Loans and How They Differ

There are numerous types of loans available, and each one serves a different financial need. Here is a breakdown of the most common loan types, including their advantages and disadvantages:

| Loan Type | Purpose | Advantages | Disadvantages |

|---|---|---|---|

| Personal Loan | General purpose (consolidating debt, expenses) | Flexible use, quick approval, no collateral | Higher interest rates, short repayment terms |

| Mortgage Loan | Home purchase or refinance | Lower interest rates, long repayment terms | Requires down payment, strict qualifications |

| Auto Loan | Purchasing a car | Easier approval, relatively low rates | Vehicle serves as collateral, limited to car purchase |

| Student Loan | Education-related expenses | Low interest rates, deferment options | Repayment begins after graduation, interest accumulation |

| Business Loan | Funding for a business | Can finance expansion, tax advantages | Requires solid business plan and collateral |

| Payday Loan | Short-term emergency needs | Fast access to cash, no credit check | Extremely high interest rates, short repayment terms |

| Home Equity Loan | Borrowing against home equity | Lower interest rates, large loan amounts | Risks foreclosure, long repayment terms |

| Debt Consolidation Loan | Consolidating multiple debts | Simplifies finances, lower interest rates | Requires good credit, loan approval based on credit score |

How to Choose the Best Loan for Your Situation

Choosing the best loan involves considering several factors, including the purpose of the loan, interest rates, repayment terms, and your creditworthiness. Here are some key steps to help you make an informed decision:

1. Identify Your Loan Purpose

Understand exactly why you need the loan. Are you consolidating debt? Buying a car? Financing education? Different loan types are better suited for different purposes. For example, if you’re buying a house, a mortgage is your best option. If you need money for personal expenses, a personal loan may be more appropriate.

2. Compare Interest Rates

Interest rates vary significantly depending on the loan type and the lender. It’s crucial to compare rates across multiple lenders. For example, mortgage rates are often lower than personal loan rates, but the repayment term for a mortgage is much longer.

3. Consider the Repayment Terms

Repayment terms vary by loan type. Personal loans may have shorter repayment periods (e.g., 3-5 years), while mortgages can extend up to 30 years. Longer repayment terms typically mean lower monthly payments but more interest paid over time.

4. Understand Fees and Other Costs

Lenders may charge fees for processing your loan, late payments, or early repayment. These fees can add up quickly, so always read the fine print to understand the total cost of the loan.

5. Check Your Credit Score

Your credit score significantly impacts the loan amount, interest rate, and approval process. Individuals with higher credit scores usually receive lower interest rates and better loan terms.

Key Statistics on Loan Markets (2025/2026 Trends)

- Mortgage Market: As of 2025, mortgage interest rates are expected to remain relatively stable at around 4-5%, with government-backed loans continuing to dominate the low-income housing sector.

- Personal Loan Growth: Personal loans have increased by 10% annually over the last 5 years, reflecting an increasing number of borrowers seeking unsecured debt options.

- Online Lending: Online lenders are expected to grow by 12% annually, surpassing $200 billion in loans disbursed by 2026 due to greater consumer demand for quick, convenient loans.

- Student Loan Debt: The student loan market continues to expand, with over $1.6 trillion in student loan debt in the U.S. as of 2025, and projections indicate that it will surpass $2 trillion by 2026.

Advantages and Disadvantages of Different Loan Sources

| Loan Source | Advantages | Disadvantages |

|---|---|---|

| Traditional Banks | Stable, regulated, competitive rates | Lengthy approval process, strict qualification criteria |

| Credit Unions | Lower rates, personalized service | Limited membership, smaller loan options |

| Online Lenders | Fast approval, minimal paperwork | Higher rates, less personal service |

| Peer-to-Peer Lending | Competitive rates, flexibility in approval | Loan amounts may be limited, fees for servicing |

| Government Loans | Lower interest rates, tax advantages, subsidized | Strict eligibility, bureaucratic application process |

| Private Lenders | Flexible terms, personal touch | Informal agreements, potential for personal conflicts |

Conclusion

Understanding where loan money comes from and the various types of loans available is essential for making the best financial decision. By carefully considering the purpose of the loan, the lender, interest rates, and repayment terms, you can choose a loan that fits your needs and financial goals. Whether you’re applying for a personal loan, mortgage, auto loan, or student loan, each type of loan serves a different purpose, so make sure to select the one that aligns with your situation.

As the lending market continues to evolve, staying informed about trends in interest rates, loan products, and online lending platforms can help you secure the best deal possible for your financial future.

Useful Links: