Chase is one of the largest and most influential credit card issuers in the United States, offering a vast and diverse portfolio of cards ranging from no-annual-fee cash-back options to ultra-premium travel cards. The defining feature of the Chase ecosystem is the Ultimate Rewards (UR) program, which provides unmatched flexibility and high redemption value, making Chase cards the cornerstone of many consumers’ and travelers’ financial strategies.

This extensive analysis will explore the key advantages, common drawbacks, and strategic recommendations for navigating the Chase credit card landscape.

Part I: The Core Advantage — The Ultimate Rewards Ecosystem

The primary draw for many Chase customers is the Ultimate Rewards program, a proprietary currency that offers unparalleled versatility.

1. High Earning Potential

Chase cards often feature tiered reward structures that allow users to earn high multipliers (e.g., 3x, 5x) in common spending categories:

- Dining and Travel: Cards like the Chase Sapphire Preferred® Card and Chase Sapphire Reserve® offer elevated points in these high-value categories, aligning with the lifestyles of frequent travelers and diners.

- Rotating Categories: The Chase Freedom Flex℠ provides 5% cash back (5x points) on up to $1,500 in combined purchases in rotating categories each quarter (e.g., gas stations, grocery stores, select streaming services).

- Flat-Rate Rewards: Cards like the Chase Freedom Unlimited® offer a competitive baseline reward (often 1.5% cash back or 1.5x points) on all non-bonus purchases.

2. Unmatched Redemption Flexibility

Ultimate Rewards points are most valuable due to the diverse ways they can be redeemed:

- Cash Back: Points can be redeemed for statement credits or direct deposits at a value of 1 cent per point (1 UR = $0.01).

- Booking Travel through the Chase Portal: Cardholders can book flights, hotels, and rental cars directly through the Chase Travel portal. Points redeemed this way are often boosted, particularly with Sapphire cards (e.g., 1.25 cents or 1.5 cents per point).

- 1:1 Point Transfers: This is the most valuable feature. Premium cardholders (Sapphire or Ink Business Preferred) can transfer points at a 1:1 ratio to leading airline and hotel loyalty programs (e.g., United MileagePlus, Southwest Rapid Rewards, World of Hyatt). This often allows consumers to secure business-class flights or luxury hotel stays that yield a value far exceeding 2 cents per point.

- Pay Yourself Back: Chase frequently offers promotional periods where points can be redeemed for a statement credit against specific categories of purchases (like groceries or home improvement) at an elevated rate, similar to the travel portal boost.

3. The Power of «Pairing» (The Chase Trifecta)

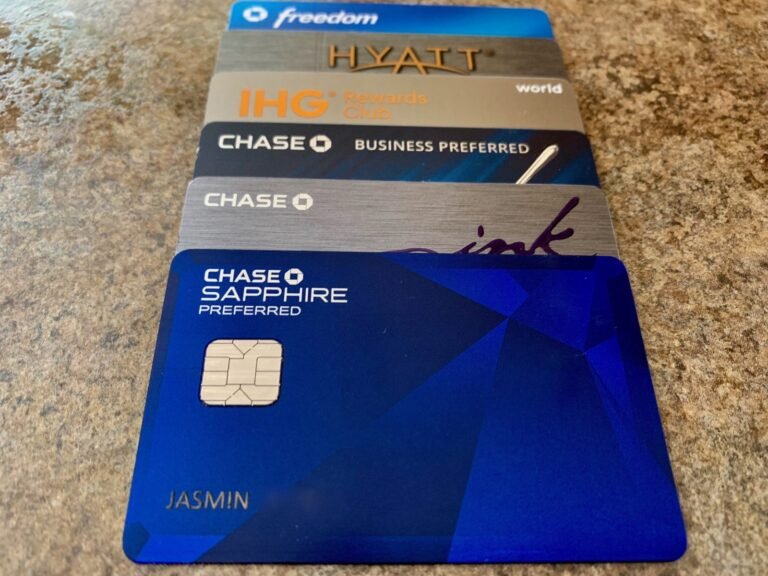

Chase’s system is designed to reward customers who use multiple cards. The «Chase Trifecta» strategy involves holding one premium travel card (to unlock point transfers) and several no-annual-fee cash-back cards (to maximize points earned in different categories). All points earned across these cards can then be pooled into the premium account to leverage the highest redemption values.

Part II: Key Advantages and Benefits

The strength of Chase extends beyond the rewards structure and includes substantial consumer protections and premium travel benefits.

Advantages:

- Premium Travel Protections: Sapphire cards are renowned for offering robust travel insurance, including Trip Cancellation/Interruption Insurance, Primary Auto Rental Collision Damage Waiver, and Baggage Delay Insurance. These benefits can save cardholders hundreds or thousands of dollars in unforeseen circumstances.

- Purchase Protection: Many Chase cards offer protection against damage or theft of eligible new purchases for a set period (e.g., 120 days) and extend the manufacturer’s warranty by an additional year.

- Sign-Up Bonuses (Welcome Offers): Chase is famous for offering some of the industry’s most lucrative sign-up bonuses, often providing a large sum of Ultimate Rewards points after meeting an initial spending requirement. This initial haul often covers the annual fee for years.

- Customer Service and Security: Chase maintains a strong reputation for fraud protection (Zero Liability Protection) and offers accessible digital banking tools via the Chase Mobile app and online portal.

- Wide Portfolio: Chase provides dedicated cards for almost every profile: students (Chase Freedom Rise℠), small business owners (Ink Business cards), travelers (Sapphire cards), and cash-back maximizers (Freedom cards).

Part III: The Drawbacks and Strict Limitations

Despite the major benefits, the Chase ecosystem comes with unique restrictions and high costs that must be understood.

Disadvantages:

- The «5/24 Rule»: This is arguably the most famous limitation in the credit card industry. Chase will generally deny an application for most of its branded cards if the applicant has opened five or more personal credit card accounts (from any issuer) in the last 24 months. This forces applicants to prioritize Chase cards early in their credit journey.

- High Annual Fees (Premium Cards): While the rewards are rich, the premium travel cards (like the Chase Sapphire Reserve) come with high annual fees (often $550 or more). Consumers must actively use the card’s credits and benefits (e.g., travel credits, lounge access) to offset this cost.

- High Variable APRs: Like most bank-issued credit cards, Chase’s non-promotional APRs are high. If a cardholder carries a balance beyond any introductory 0% APR period, the high interest charges will rapidly negate any value gained from rewards.

- No Universal Free Foreign Transactions: While Sapphire cards famously do not charge foreign transaction fees, many of the no-annual-fee cards (like the Freedom series) do charge a foreign transaction fee (often 3%). This means they are poor choices for international travel.

- Complexity: Maximizing the value of the Ultimate Rewards program requires strategy—knowing which cards to pair, when to transfer points to a travel partner, and which quarterly bonus categories to activate. This complexity can be overwhelming for casual users.

Part IV: Strategic Recommendations for Different User Profiles

The key to success with Chase is selecting the card that aligns with your spending habits and travel goals.

| User Profile | Recommended Card(s) | Strategy |

| The Casual Traveler | Chase Sapphire Preferred® Card (Lower Annual Fee) | Use for all travel and dining. Transfer points to airlines/hotels for high-value redemptions or use the 1.25x redemption boost in the travel portal. |

| The Premium Traveler | Chase Sapphire Reserve® (High Annual Fee) | Use for frequent travel to maximize high travel credits, airport lounge access, and the 1.5x point redemption boost. |

| The Cash Back Maximizer | Chase Freedom Flex℠ and Chase Freedom Unlimited® | Use the Flex for the rotating 5% bonus categories and the Unlimited for 1.5% back on all other purchases. Pool points into a Sapphire card for maximum value. |

| The Small Business Owner | Chase Ink Business Cash® or Ink Business Preferred® | Use the Ink Cash for high cash back on categories like office supply stores and internet services. Use the Ink Preferred for travel and to enable point transfers. |

Final Caveat: The best credit card strategy is one rooted in responsible spending. The benefits of the Chase ecosystem are only realized when balances are paid in full every month to avoid the high APR charges. For responsible users, Chase offers one of the most powerful and rewarding programs available globally.